A new column from the Center for American Progress estimates that under the Senate’s health care repeal bill, the Better Care Reconciliation Act (BCRA), opioid producers would gain millions of dollars in tax breaks, while millions of Americans would be stripped of health coverage and those suffering from the opioid epidemic would see costs skyrocket.

This includes pharmaceutical companies that are currently being sued by attorneys general in states including Ohio, Missouri, Mississippi, and Tennessee for fraudulent behavior concealing the epidemic.

Meanwhile, the BCRA would cut more than $700 billion from the Medicaid program and rip coverage from millions of people. For the estimated 220,000 people with opioid abuse disorder who have coverage through Medicaid expansion or the individual marketplace, the BCRA would put their coverage at serious risk, making it virtually impossible for them to receive the treatment they need. The severe federal cuts to Medicaid would also make it challenging for states to continue to address the crisis.

“Senators supporting this Senate health care repeal bill have their priorities all wrong. They want to decrease care and increase costs for those suffering from the opioid epidemic, while giving away millions of dollars to opioid producers. And efforts to bribe senators with last-minute funding miss the point: There’s no way to counter the damage of ripping Medicaid away from those who need it most, ” said Sam Berger, senior policy adviser at CAP. Other provisions in the BCRA would allow states to repeal essential health benefits, which under current law require insurance companies to provide coverage for substance use disorder treatment. Prior to the Affordable Care Act, 45 percent of plans in the individual marketplace did not cover substance use disorder services.

According to the nonpartisan Congressional Budget Office, under the BCRA, opioid producers stand to receive a tax break through the repeal of a fee on manufacturers and importers of brand-name prescription drugs.

The size of each company’s tax cut depends on their drug sales in any given year, but a look at past payments suggests the magnitude of the tax breaks opioid manufacturers could see. For example, Janssen Pharmaceuticals paid a fee of $220 million in 2014; Allergan paid a fee of $161 million in 2015 and $154 million in 2016; Endo paid a fee of $4 million in 2016, $11 million in 2015, and $16 million in 2014; and Cephalon paid a fee of $40 million in 2014.

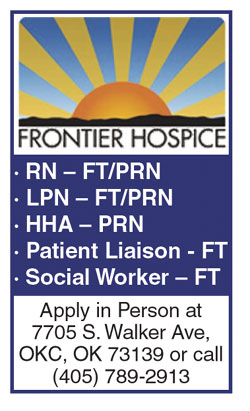

· RN – FT/PRN

· LPN – FT/PRN

· HHA – PRN

· Patient Liaison – FT

· Social Worker – FT

Apply in Person at 7705 S. Walker Ave, OKC, OK 73139 or call (405) 789-2913